Investment Choices

Providing a full range of investment choices that are designed to meet a variety of funding goals and timelines while generating competitive returns

Investments to Sustain and Fuel

Our investment options help ministries and missions thrive while meeting present and future needs. When investing through the Foundation, you are guided on a path leading to your financial goals.

All of our investments align with the United Methodist values and beliefs.

Multiple Asset Fund

The Balanced Fund seeks to maximize long-term investment returns, including current income and capital appreciation, while reducing short-term risk by investing in a broad mix of investments. This Fund is designed for investors with a relatively long-time horizon who seek long-term investment growth and income from exposure to a broadly diversified portfolio of assets with an allocation to 65% equity and 35% fixed income.

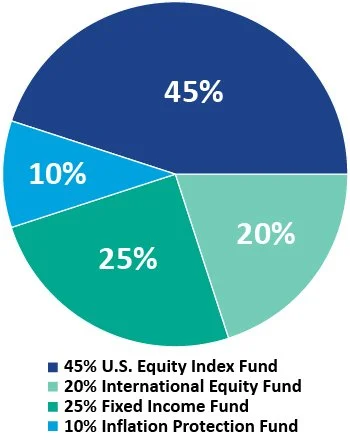

GNJ Index Growth

The GNJ Index Growth Fund mirrors the GNJ Growth Fund, placing deliberate emphasis on passive (index) for U.S. equities. This strategic alignment ensures that the fund closely replicates the investment approach of the GNJ Growth Fund while specifically focusing on the passive management or index of U.S. equity investments. Investing in an “index fund” such as the Standard and Poor’s Index assumes investment performance no better or worse than the market as a whole. An INDEX FUND charges a much lower management fee than an actively managed fund. For additional information on the GNJ Growth Index fund see prospectus .

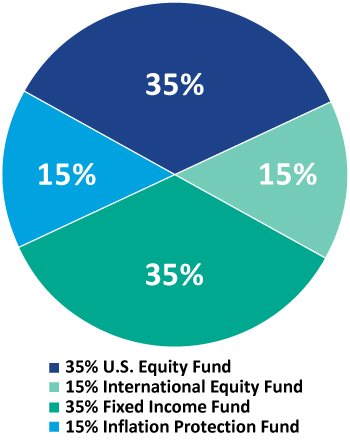

GNJ Growth

The GNJ Growth Fund is strategically crafted to optimize long-term investment returns by focusing on both current income and capital appreciation. To mitigate short-term risk, the fund adopts a well-rounded approach, diversifying across a broad spectrum of investments. Tailored for investors with a substantial time horizon, the fund aims to deliver sustained investment growth and income through exposure to a comprehensively diversified portfolio. With a deliberate allocation strategy of 65% in equities and 35% in fixed income, the fund places a heightened emphasis on U.S. equities, differentiating it from the Multiple Asset Fund.

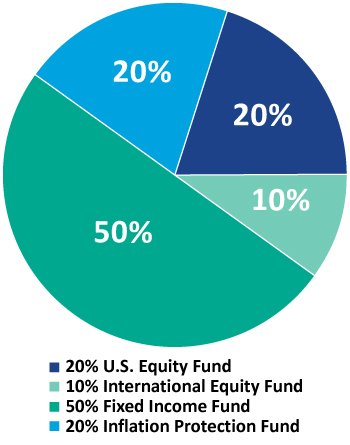

GNJ Moderate

The GNJ Moderate Fund is methodically designed to maximize long-term investment returns through a dual focus on current income and capital appreciation. To address short-term risk, the fund employs a well-rounded strategy, diversifying across a broad array of investments. Specifically tailored for investors with a longer time horizon, but with lower risk-tolerance vs. the MAF/GNJ Growth Funds, the fund seeks to achieve investment growth and income by leveraging exposure to a broadly diversified portfolio of stocks and bonds with an allocation of 50% in equities and 50% in fixed income.

GNJ Conservative

The GNJ Conservative Fund is predominantly positioned in fixed income instruments, strategically incorporating the diversification advantage of allocating a portion to equities. This fund caters to investors seeking the diversification advantages derived from a broad range of investment strategies, with a primary emphasis on fixed income instruments for short-term investments. The allocation is deliberately structured with a 70% commitment to fixed income and a 30% allocation to equities.

For full monthly presentation and disclosures, click here.

DonorView Portal

Online access for account information, consolidated reports, statements as well as deposits and withdrawals for those we serve.